The Global Advantage-How Hard Currency Fuels Africa’s Private Sector Growth

For African businesses aiming for growth, smart financing is key. While borrowing in local currency might feel safe, a closer look reveals that hard currency commercial lending (USD or EUR) often offers a more stable and affordable path to success. Savvy African businesses are increasingly making this strategic shift.

The Hidden Costs of Local Currency Loans

Local currency loans, despite seeming to eliminate “currency risk,” carry significant hidden dangers:

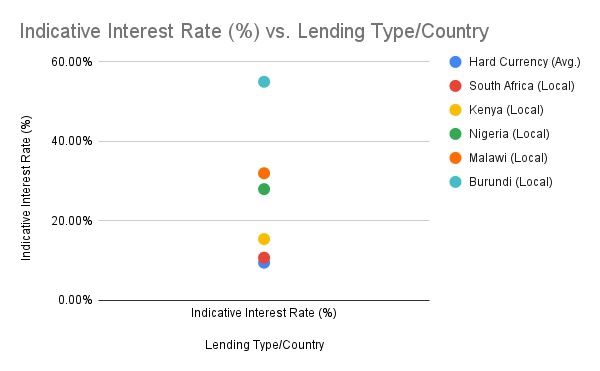

• Sky-High Interest Rates: African central banks, battling inflation, often set high policy rates. This translates to commercial lending rates soaring into double-digits—sometimes 20% or even 30%+ in certain markets, directly impacting your bottom line.

• Silent Erosion of Depreciation: Many African currencies consistently lose value against global giants like the USD or EUR. Your “stable” local currency loan quietly shrinks in real value, diminishing its purchasing power for vital imports or expansion. This “hidden cost” can easily dwarf any perceived benefit of avoiding direct foreign exchange risk.

The Hard Currency Edge: Global Money, Local Power

In contrast, hard currency loans are anchored to global markets, offering more stability.

• Much Lower Base Rates: As of mid-July 2025, a USD loan starts from SOFR, around 4.3%-4.4%.1 For Euro loans, EURIBOR hovers around 2.0%. These rates are dramatically lower than local borrowing costs.

• Clearer Pricing: A “spread” is added to these benchmarks, reflecting your country’s stability (lower for Morocco, Botswana, South Africa) and your business’s financial health.

For creditworthy private companies in stable African markets, total USD loan rates typically range from 6.0% to 9.0%, with EUR rates at 4.0% to 7.0%. Even for growing firms in less stable environments, a hard currency loan, at 9.0% to 13.0%+, remains far more competitive than a 20%+ local option.

Powering Africa’s Private Sector Future

Strategic hard currency commercial lending offers access to vast, stable global capital at competitive rates. For African businesses with foreign currency revenues or strong hedging strategies, it provides predictability, lower real costs, and the crucial scale needed to truly grow and innovate. This is how Africa’s private sector is securing its future.